Welcome to bitshak Blog. A small and basic blog site.

Notice: Undefined offset: 1 in /home/dadonkkl/bitshak.co.uk/index.php on line 71

Notice: Undefined offset: 1 in /home/dadonkkl/bitshak.co.uk/index.php on line 71

Notice: Undefined offset: 1 in /home/dadonkkl/bitshak.co.uk/index.php on line 71

Notice: Undefined offset: 1 in /home/dadonkkl/bitshak.co.uk/index.php on line 71

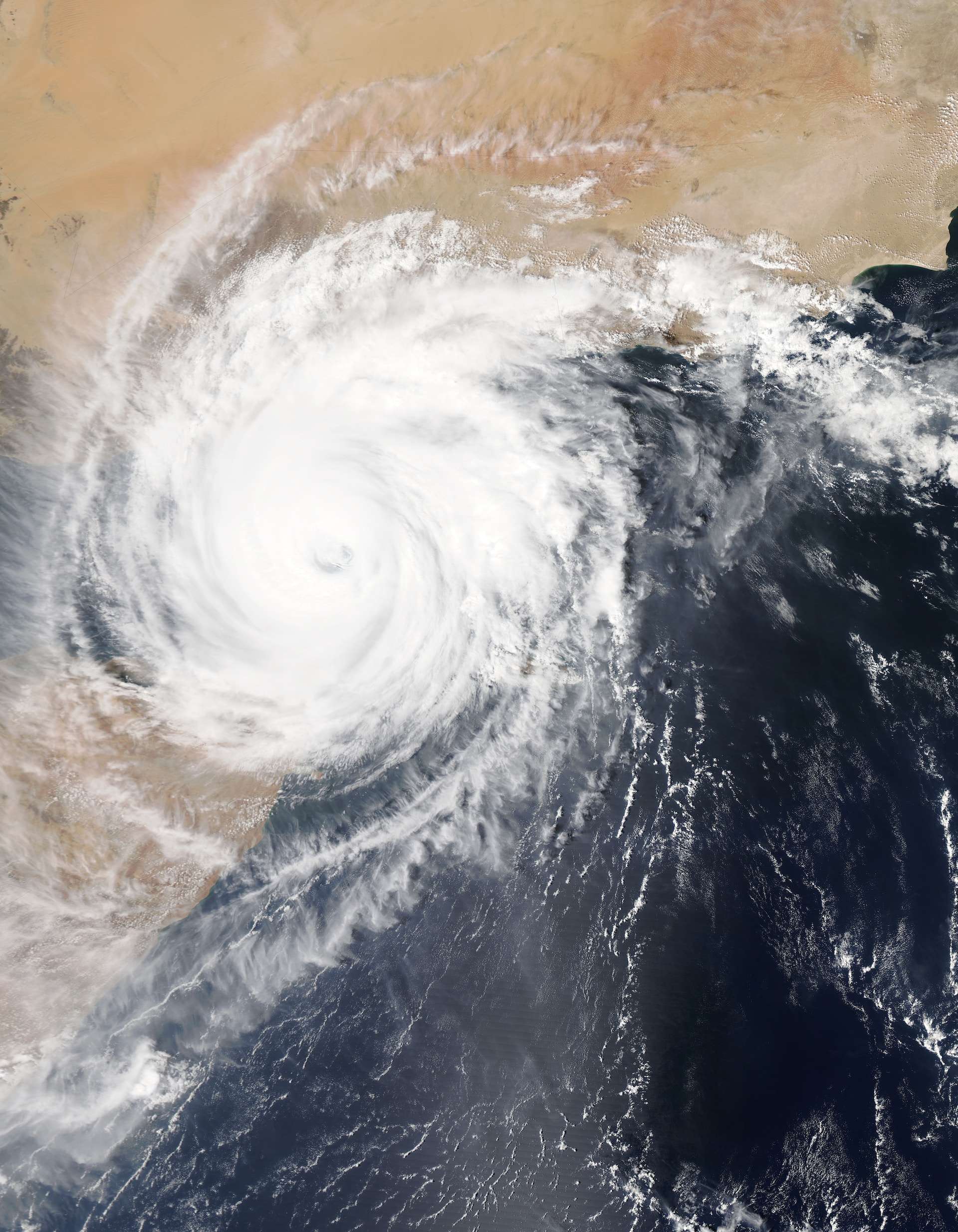

Insurance Coverage for Natural Disasters: Are You Prepared in the United States?

Natural disasters such as hurricanes, earthquakes, floods, and wildfires can cause widespread devastation and financial losses. In the United States, having appropriate insurance coverage is crucial to protect yourself and your property in the event of a natural disaster. In this article, we explore the importance of insurance coverage for natural disasters and provide essential information to help you prepare.

Understanding Natural Disaster Insurance Coverage

Natural disaster insurance coverage typically falls into two categories: property insurance and specialized coverage.

Property Insurance: Property insurance, including homeowner's insurance or renter's insurance, generally provides coverage for damage to your property caused by specified perils. These policies typically cover hazards like fire, lightning, windstorms, and hail. However, they may not include coverage for all natural disasters. It's essential to review your policy carefully to understand what perils are covered.

Specialized Coverage: For natural disasters not covered under standard property insurance, specialized coverage may be available. This can include flood insurance, earthquake insurance, or hurricane insurance. These policies provide specific protection for the respective natural disasters, helping to cover damages to your property and belongings.

Flood Insurance

Floods are among the most common and costly natural disasters in the United States. However, it's important to note that standard property insurance policies typically do not cover flood damage. To protect your property from flood-related losses, you may need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or private insurers. If you live in a high-risk flood zone, flood insurance may even be a requirement for obtaining a mortgage.

Earthquake Insurance

Earthquakes can cause significant damage to buildings and infrastructure. Standard property insurance policies typically exclude coverage for earthquake-related damages. If you reside in an area prone to earthquakes, it's wise to consider purchasing earthquake insurance. These policies provide coverage for structural damage to your property and may also cover additional expenses such as temporary living arrangements if your home becomes uninhabitable.

Hurricane Insurance

Hurricanes can cause severe wind and water damage, including storm surge, heavy rain, and high winds. Depending on your location, your standard property insurance policy may or may not include coverage for hurricane-related damages. It's crucial to review your policy and consider purchasing additional hurricane coverage if necessary. Some coastal areas may require separate windstorm or hurricane deductibles.

Preparing for Natural Disasters

Insurance coverage is just one aspect of preparing for natural disasters. Here are some additional steps you can take:

Assess Your Risks: Understand the natural disaster risks specific to your area. Research historical data and consult with local authorities or experts to determine the likelihood of various hazards.

Create an Emergency Plan: Develop a comprehensive emergency plan for you and your family. This should include evacuation routes, a communication strategy, and arrangements for pets and valuable belongings.

Secure Your Property: Take measures to fortify your property against potential damage. This may include reinforcing windows, securing loose objects, trimming trees, and implementing flood prevention measures.

Document Your Belongings: Create a thorough inventory of your personal belongings, including photographs or videos, and keep important documents in a safe and easily accessible place. This will help streamline the insurance claims process in the event of a natural disaster.

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164

Notice: Undefined variable: footer_navigation_ad_size_end in /home/dadonkkl/bitshak.co.uk/index.php on line 164